What are the Prospects for Lumber Prices?

What are the Prospects for Lumber Prices?

The odds favor higher lumber prices over the coming months as the fundamental supply-demand balance suggests that lumber demand will increase. While lumber prices could move lower, the upside price potential remains far greater than the downside price risk in early 2025.

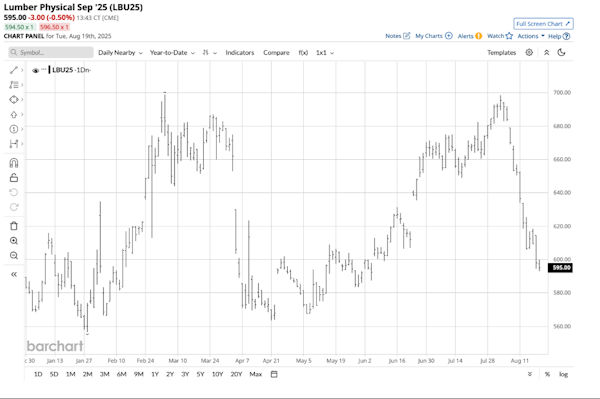

Nearby CME physical lumber futures were at the $610 per 1,000 board feet level on February 14, 2025, with the high reaching $635. The nearby September CME lumber futures were lower in August 2025, after trading to a high of over $700 per 1,000 board feet in late March, at which point they ran out of upside steam.

A lower high in early August 2025

Nearby CME lumber futures have traded in a $556.50 to $699 range in 2025, with the low on January 28 and the high on March 4.

The year-to-date continuous physical lumber futures chart shows that the lumber futures rose to just shy of the March 4 high on August 1 when the price rose to a $698.50 peak where it ran out of upside steam. Lumber futures fell below $600 per 1,000 board feet on August 18.

Heading into the offseason for demand

Lumber futures peaked in May 2021 and March 2022 as wood prices tend to reach annual highs during spring, at the beginning of the construction season when demand increases.

With fall on the horizon, construction projects and lumber demand will decline as the temperatures drop and fall gives way to winter. Therefore, seasonality could lead to lower wood prices over the coming weeks and months.

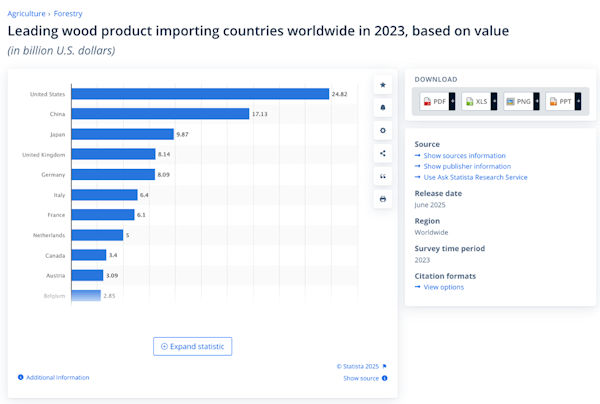

The United States is the top wood-importing country, with around 45% more wood imports than second-place China.

Trade issues and tariffs could be a significant factor in determining the path of least resistance for lumber, lumber futures, and wood product prices over the coming weeks and months. Tariffs distort prices, creating oversupply in some regions and shortages in others. Therefore, we should expect elevated price variance in the lumber futures market over the remainder of 2025 and into 2026, as the peak demand season approaches in spring.

WOOD, CUT, and WY trend to move with lumber prices- A scale-down approach if lumber prices come under pressure for the rest of 2025

CME physical lumber futures remain highly illiquid, with the total number of open long and short positions at 6,606 contracts as of August 18. On many days, fewer than 1,000 contracts change hands, making trading, investing, or hedging with lumber futures dangerous. Lumber’s low liquidity tends to exacerbate price variance, creating price gaps that prevent smooth and efficient purchase and sale execution.

The following ETFs and stock tend to be proxies for lumber prices, and could experience upward pressure if lumber prices rally in 2026:

- WOOD: At $74.45 per share, the iShares Global Timber & Forestry ETF (WOOD) owns a portfolio of lumber-related companies. WOOD is an ETF with over $244 million in assets under management. WOOD trades an average of around 5,608 shares daily and charges a 0.40% management fee. WOOD’s $1.09 annual dividend translates to a 1.46% yield.

- CUT: At $30.63 per share, the Invesco MSCI Global Timber ETF (CUT) also owns a portfolio of lumber-related companies. CUT is an ETF with over $47 million in assets under management. CUT trades an average of around 2,313 shares daily and charges a 0.60% management fee. CUT’s $0.97 annual dividend translates to a 3.17% yield.

- WY: At $26.30 per share, Weyerhaeuser Company (WY) operates as a real estate investment trust with a call option on lumber prices as it owns or leases timberlands in the U.S. and Canada. WY’s market cap at over $18.50 billion makes it a highly liquid stock. WY trades an average of over 4.27 million shares daily. WY’s $0.82 annual dividend translates to an attractive 3.12% yield.

The offseason for lumber demand is on the horizon. The potential for increased price variance due to the uncertainty created by U.S.-Canada trade relations remains high, and the path of least resistance of U.S. short-term interest rates is likely to be lower. Time will tell if longer-term rates follow any Fed Rate cuts over the coming months. Lumber remains a critical construction material, and the current price levels offer a positive risk-reward profile. Accumulating lumber-related assets on a scale-down basis during periods of price weakness over the coming weeks and months could be optimal for 2026, provided the housing market improves and lumber demand rises.

Source: barchart